W2 payroll tax calculator

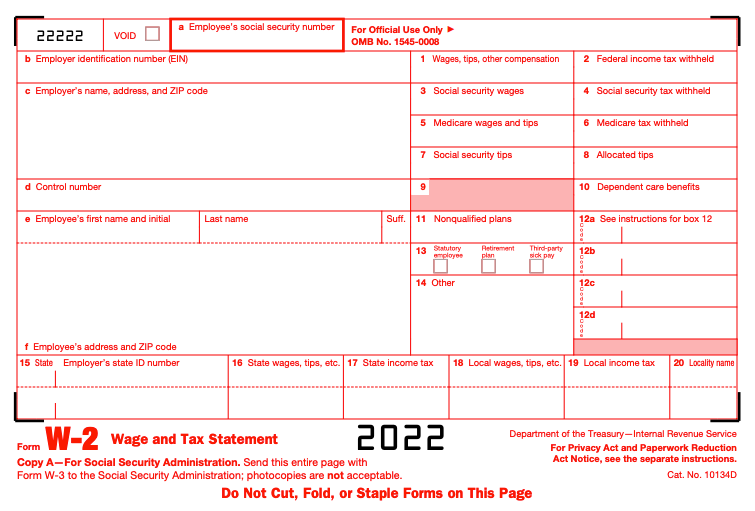

Free 2022 Employee Payroll Deductions Calculator. Ad Fill Out Fields Make an IRS W-2 Print File W-2 Instantly For Free.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

1 Use Our W-2 Calculator To Fill Out Form.

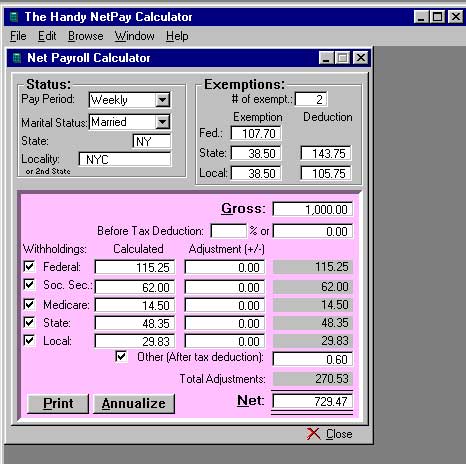

. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll. Skip To The Main Content.

Get Trusted W-2 Forms - Fill Out And File - 100 Free. Ad Compare This Years Top 5 Free Payroll Software. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Use this calculator to view the numbers side by side and compare your take home income. The standard FUTA tax rate is 6 so your max. Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 100 Free.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. See how your refund take-home pay or tax due are affected by withholding amount. Access IRS Tax Templates Online.

All Services Backed by Tax Guarantee. Ad Use Our W-2 Calculator To Fill Out Form. Ad Payroll So Easy You Can Set It Up Run It Yourself.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Free Unbiased Reviews Top Picks. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Time and attendance monitoring just got a whole lot easier. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. How It Works.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. The maximum an employee will pay in 2022 is 911400.

Get Your Quote Today with SurePayroll. Could be decreased due to state unemployment. Plug in the amount of money youd like to take home.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Ad Break up with punch cards timesheets and long days of calculating everyones hours. Get Started Today with 2 Months Free.

Ad Compare This Years Top 5 Free Payroll Software. Estimate your federal income tax withholding. Medicare 145 of an employees annual salary 1.

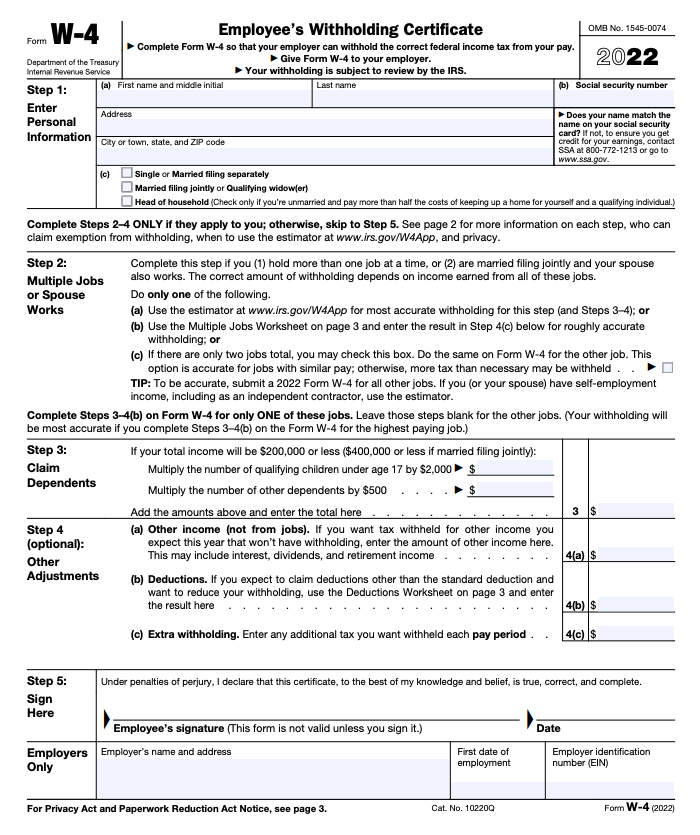

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Use this tool to. The information you give your employer on Form W4.

Create Your IRS W-2 Form Online Free E-file Print In Minutes - Try Free. For help with your withholding you may use the Tax Withholding Estimator. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

You can use the Tax Withholding. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Withholding schedules rules and rates are.

Federal Salary Paycheck Calculator. IRS tax forms. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their. Get an accurate picture of the employees gross pay.

Your employer withholds a 62 Social Security tax and a. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Free Unbiased Reviews Top Picks.

If you work for. File Online Print - 100 Free. 2 File Online Print - 100 Free.

Microsoft Dynamics Gp Year End Update 2020 W 2 Tips And Tricks Smb Suite Next Is Now

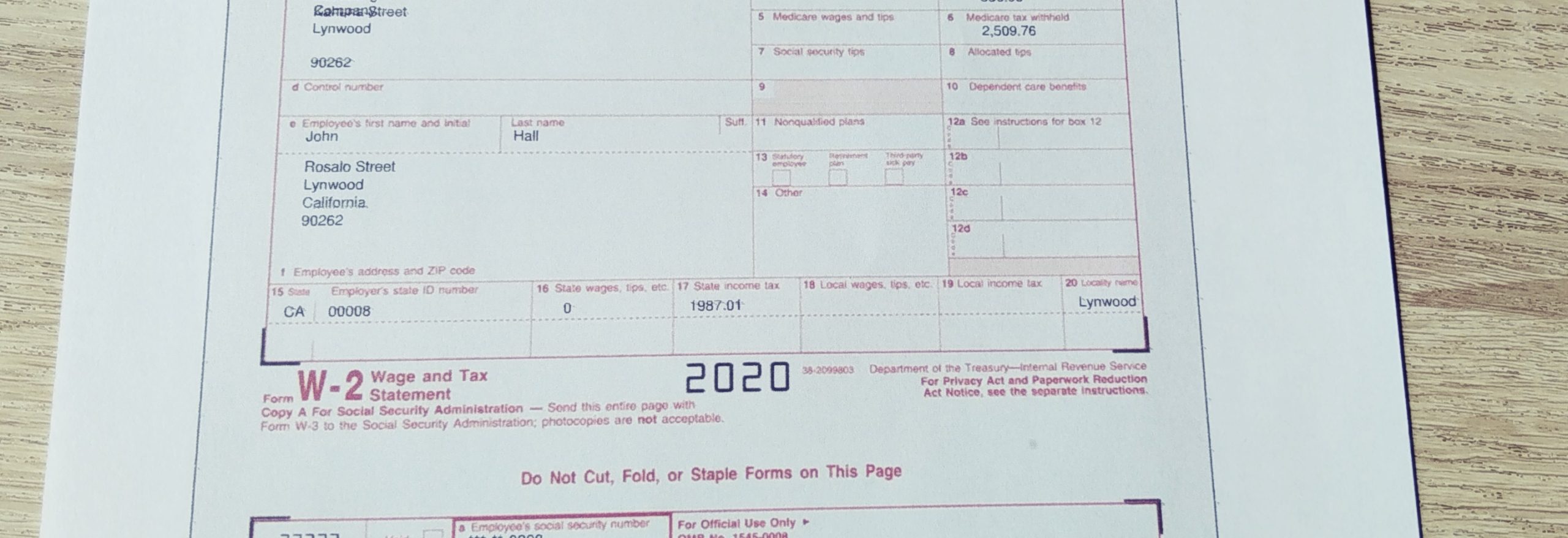

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2019 Federal Income Withhold Manually

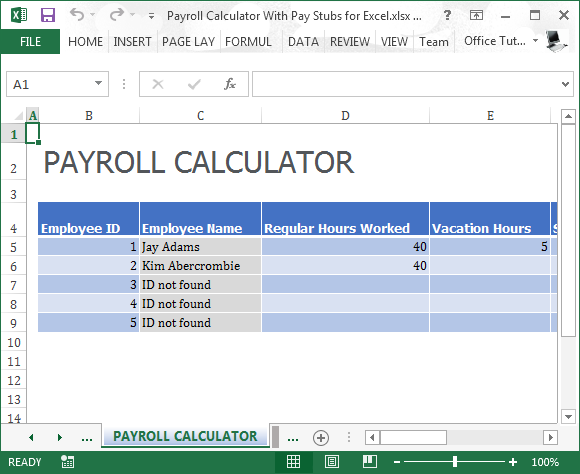

Payroll Calculator With Pay Stubs For Excel

Calculation Of Federal Employment Taxes Payroll Services

W 2 And W 4 What They Are And When To Use Them Bench Accounting

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

Paycheck Manager Expert Review Pricing Alternatives 2022 Selectsoftware Reviews

How To Calculate W2 Wages From Paystub Paystub Direct

Free Payroll Tax Paycheck Calculator Youtube

Payroll Calculator With Pay Stubs For Excel

Federal Income Tax Fit Payroll Tax Calculation Youtube

W 2 And W 4 What They Are And When To Use Them Bench Accounting

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections